Recovery - The Growing Global Opportunity

Publication | 01.19.16

An increasing number of U.S. corporations have found that a more proactive approach to recovering damages can be well worth the effort. And with the evolution of private damages laws in many countries, the opportunities for recovery are now expanding globally.

In the U.S., the pursuit of private damages is well established, and law departments have successfully pursued significant recoveries in areas such as antitrust, intellectual property, and trade cases, among others. “Some efforts have worked so well that the corporate law department is changing from being a cost center to a profit center,” says Jerome Murphy, a partner in Crowell & Moring’s Antitrust and Commercial Litigation groups.

However, in most other countries, the legal frameworks have provided only limited opportunities to recover private damages. But that is changing—particularly in the antitrust arena. In recent years, some European countries—including the U.K., Germany, and the Netherlands—have become more open to such actions. In addition, a major shift is now underway with the implementation of the European Union (EU) Directive on antitrust damages. The Directive is designed to provide a uniform EU-wide approach that allows individuals and companies to claim damages when they are victims of anti-competitive behavior, while also making it easier for them to access the evidence they need to prove their claims. This Directive was adopted in late 2014, and EU countries are required to implement it in their national laws by December 2016.

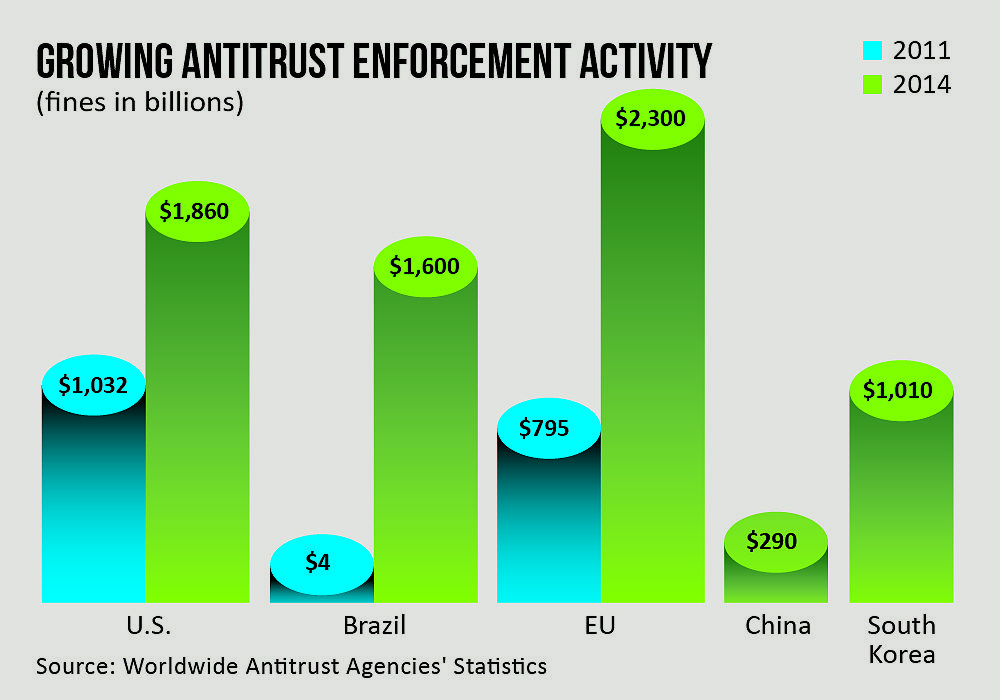

Meanwhile, a number of Asian countries are showing a growing interest in stricter antitrust enforcement, with some— such as Japan, South Korea, and Taiwan—allowing private antitrust actions. Over the past few years, China has been especially active. Under the country’s Anti-Monopoly Law (AML), regulators have fined a number of auto companies and suppliers along with contact lens, dairy, chipset, and LCD screen producers. In 2015, the fines were the largest yet under the AML, with one company fined almost $1 billion—and it appears that the focus on enforcement will continue. The AML allows private actions, and although those have been slow to develop, in time “China’s aggressive enforcement may lead to follow-on private litigation, opening the door to significant recovery opportunities,” says Murphy.

To take full advantage of these types of opportunities, law departments need to carefully coordinate their international recovery efforts across jurisdictions. Although more and more countries allow private damages suits, “there are significant differences in jurisdictions,” says Murphy. “There are many variables to consider—costs, the extent of discovery, the defenses that are allowed, and the potential damages that may be awarded.” Companies may also consider using the leverage gained through recovery to negotiate better agreements, rather than collect funds—something that might make sense when they’re dealing with a key supplier that they would rather not take to court.

At the same time, law departments should monitor the changes in legal frameworks taking place around the globe. For example, many countries are stepping up intellectual property enforcement, which could bring additional recovery opportunities. Overall, says Murphy, “with the increasingly global nature of private damages actions, in-house counsel need to think about the real potential of recoveries outside the United States, and coordinate their efforts accordingly.”

[Antitrust enforcement is becoming more rigorous in many countries—and fines are growing. In more and more countries, this increased activity is opening the door to private antitrust lawsuits—and potentially, more recovery opportunities.]

[PDF Download: 2016

| |

[Web Index: 2016 Litigation

|

Contacts

Insights

Publication | 03.31.25

Health System Settles FCA Case Over PPP Loan 03.31.25 Report on Medicare Compliance

Publication | 03.24.25