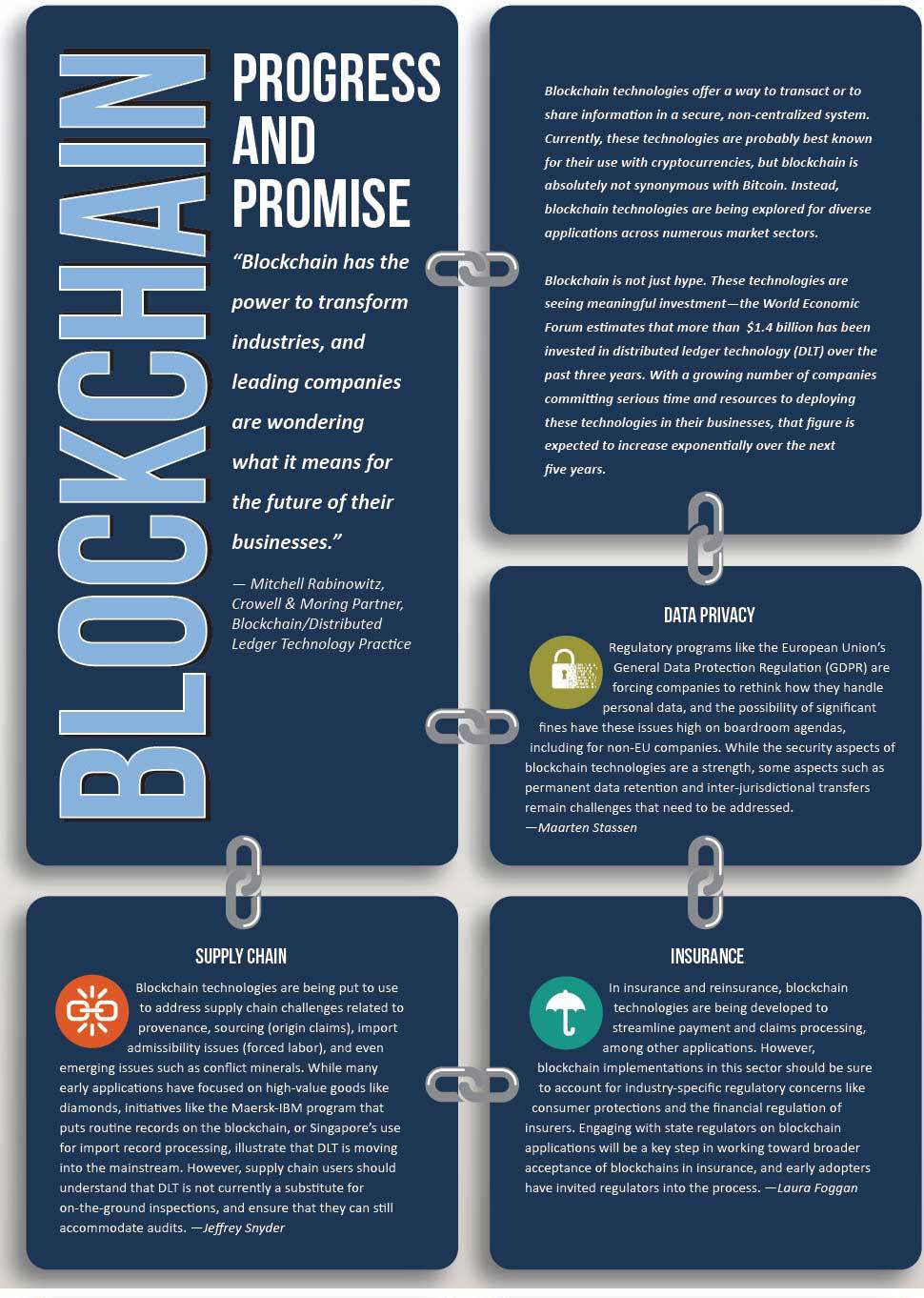

Blockchain – Progress and Promise

Publication | 02.28.18

[ARTICLE PDF]

Blockchain technologies offer a way to transact or to share information in a secure, non-centralized system. Currently, these technologies are probably best known for their use with cryptocurrencies, but blockchain is absolutely not synonymous with Bitcoin. Instead, blockchain technologies are being explored for diverse applications across numerous market sectors.

Blockchain technologies offer a way to transact or to share information in a secure, non-centralized system. Currently, these technologies are probably best known for their use with cryptocurrencies, but blockchain is absolutely not synonymous with Bitcoin. Instead, blockchain technologies are being explored for diverse applications across numerous market sectors.

Blockchain is not just hype. These technologies are seeing meaningful investment—the World Economic Forum estimates that more than $1.4 billion has been invested in distributed ledger technology (DLT) over the past three years. With a growing number of companies committing serious time and resources to deploying these technologies in their businesses, that figure is expected to increase exponentially over the next five years.

DATA PRIVACY

Regulatory programs like the European Union’s General Data Protection Regulation (GDPR) are forcing companies to rethink how they handle personal data, and the possibility of significant fines have these issues high on boardroom agendas, including for non-EU companies. While the security aspects of blockchain technologies are a strength, some aspects such as permanent data retention and inter-jurisdictional transfers remain challenges that need to be addressed. —Maarten Stassen

INSURANCE

In insurance and reinsurance, blockchain technologies are being developed to streamline payment and claims processing, among other applications. However, blockchain implementations in this sector should be sure to account for industry-specific regulatory concerns like consumer protections and the financial regulation of insurers. Engaging with state regulators on blockchain applications will be a key step in working toward broader acceptance of blockchains in insurance, and early adopters have invited regulators into the process. —Laura Foggan

SUPPLY CHAIN

Blockchain technologies are being put to use to address supply chain challenges related to provenance, sourcing (origin claims), import admissibility issues (forced labor), and even emerging issues such as conflict minerals. While many early applications have focused on high-value goods like diamonds, initiatives like the Maersk-IBM program that puts routine records on the blockchain, or Singapore’s use for import record processing, illustrate that DLT is moving into the mainstream. However, supply chain users should understand that DLT is not currently a substitute for on-the-ground inspections, and ensure that they can still accommodate audits. —Jeffrey Snyder

ENERGY

Blockchain technologies are being tested throughout the energy supply chain, including those that track ownership and country of origin for commodities like oil; decrease variance between energy supply and demand by allowing utilities and demand response providers to record energy usage in real-time; deploy “smart” devices to minimize consumers’ energy costs; and facilitate peer-to-peer transactions, such as in community microgrids where neighbors can buy and sell electricity among each other. Because the energy industry is highly regulated, companies should understand how local, state, and federal regulations impact the blockchain technologies they are considering, and if public utility commissions’ approval is needed. —Matthew Welling

INITIAL COIN OFFERINGS

Many blockchain startups are raising funds through “initial coin offerings” (ICOs)—sales of assets tracked through blockchain technology. The “coins” issued through an ICO can represent the right to use a startup’s services or be the means of processing distributed applications. Most issuers are taking the position that their coins are not regulated under securities laws, commodities regulations, or money transmission rules. However, the SEC has spoken out about the potential of virtual coins to be subject to its regulations. Companies considering ICOs should be aware that consumer protection authorities may investigate token sales, and state governments are seeking to implement their own regulations. —Jenny Cieplak

HEALTH CARE

Blockchain technologies are being explored to address the significant challenges associated with managing health data, which is currently siloed. Problems exist with interoperability at all levels, but blockchain solutions show promise in applications such as connecting clinical data and creating longitudinal health records; managing wearable and patient-generated data; managing patient consent; facilitating patient-centered outcomes research and precision medicine research; and managing patient and provider identity. However, organizations should be aware that these exciting applications must also address the unique legal and regulatory challenges associated with health data. —Jodi Daniel

FINANCE

Although some in the FinTech industry have assumed that it will take years to replace legacy systems with new blockchain systems, 2018 is likely to see the first broad-based implementations. From a blockchain-based reporting platform for credit default swaps, to trading platforms for syndicated loans, companies are planning production launches for early 2018. Regulators have already begun making updates to accommodate new technologies—such as the CFTC's changes to its record-keeping requirements to make them technology- neutral—but additional rulemakings may be required to fully implement production solutions. —Mitchell Rabinowitz

2018 is the year that many blockchain and DLT providers expect to move from proof-of-concept to live solutions. But before live use, providers will need to demonstrate—both to regulators and to their customers—that their solutions help users comply with a wide array of regulations. Data privacy, know-your-customer, and sanctions and export control compliance must all be addressed.

Nevertheless, blockchain and DLT offer too many benefits for these technologies to be ignored. General benefits such as more accurate data, faster back-office processing, automated transactions, and the elimination of reconciliation requirements are applicable to all industries. Industry-specific use cases are being developed for energy, insurance, and health care, and participants will need to understand and evaluate these use cases.

As blockchain continues to move into the mainstream, companies will need to develop a blockchain strategy, and to decide whether and how to participate in and use blockchain. Organizations should be preparing for those discussions.

Insights

Publication | 03.31.25

Health System Settles FCA Case Over PPP Loan 03.31.25 Report on Medicare Compliance

Publication | 03.24.25