Treasury and the IRS Issue Much Anticipated Proposed Regulations on Transferability and Direct Pay of Energy Credits Under the Inflation Reduction Act

Client Alert | 15 min read | 06.22.23

On June 14, 2023, the Treasury Department and the Internal Revenue Service (IRS) released proposed regulations regarding the clean energy tax credits eligible for direct pay and transferability under the Inflation Reduction Act (IRA). The IRS also released FAQs for both direct pay and transferability, which provides further guidance to interested taxpayers.

Tax equity deals have historically been difficult to come by for smaller energy developers and newer technologies in the middle market. The direct pay and transferability provisions in the IRA are intended to spur growth and create new opportunities in the clean energy market by allowing some developers to build projects at a faster pace and more affordably. We expect the tax equity market to continue to be strong, particularly with the issuance of this latest guidance addressing direct pay and transferability. Significantly, the guidance opens new doors for some tax-exempt entities that previously have not been able to access credits in the same manner as other taxpayers and creates a marketplace for the sale and purchase of certain energy tax credits.

Taxpayers should review existing agreements and proposed transactions, especially those related to production tax credits or investment tax credits and consider any revisions and amendments to address changes stemming from the enactment of the IRA and related guidance.

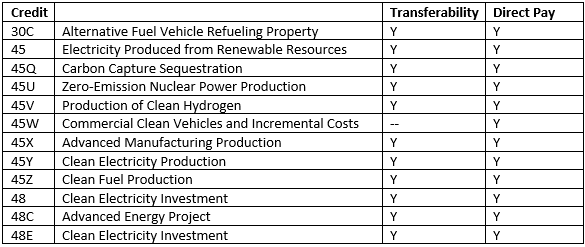

Eligible Credits

Transferability

Taxpayers eligible for the credits listed in the chart above (with the exception of § 45W), may transfer credits to unrelated third parties. Some of the key clarifications in the proposed regulations include the following:

- Transferees must pay for the credit in cash (i.e., cash, check, cashier’s check, money order, wire transfer, ACH transfer, or other bank transfer of funds that are immediately available).

- The credit can be transferred to multiple transferees. Taxpayers also may transfer only a portion of the credit and retain the remainder.

- The credit amount cannot be separated from any “bonus” credit portions (i.e. taxpayers cannot transfer a portion of an eligible credit related solely to a bonus credit amount). If an entire credit is transferred, the entire bonus credit must be included in the transfer. If a portion of the credit is transferred, the same proportional amount of any bonus credit must be transferred.

- There are several requirements for transferring a credit, including:

- Pre-filing registration through an IRS portal, which should be available by late 2023;

- Filing a form 3800, General Business Credit (or a successor form); and

- Including a “Transfer Election Statement”

- Once a transfer is made, it is irrevocable and cannot be transferred back to the transferor and cannot be transferred to another party. The regulations clarify that brokers can help foster a relationship between a transferor and a transferee, but may not purchase the credit and then transfer it to a subsequent transferee.

- In the event of a subsequent recapture event for credits under §§ 48, 48E, or 48C, the transferee has the financial responsibility to recapture the amount of the previously claimed credit. The transferor has the duty to notify the transferee of the recapture event.

Direct Pay

Of the various credits provided in the IRA, taxpayers who fall within the definition of “applicable entities,” may receive a cash payment from the government for the credits listed above, rather than apply the credit on their tax return.

Section 6417 identifies the following “applicable entities” for direct payment: tax-exempt organizations, States, and political subdivisions such as local governments, Indian tribal governments, Alaska Native Corporations, the Tennessee Valley Authority, rural electric co-operatives, U.S. territories and their political subdivisions, and agencies and instrumentalities of state, local, tribal, and U.S. territorial governments. The proposed regulations provide further definition of “applicable entities”, as follows:

- Organizations exempt from the tax imposed by subtitle A

- The proposed regulations clarify that organizations under § 501(a) can qualify, along with any government of a US territory.

- State or political subdivision

- Treasury and the IRS confirmed that the District of Columbia falls within this applicable entity and requested comments on whether additional clarification is needed.

- Tennessee Valley Authority

- The proposed regulations provide no further clarification, nor did the Treasury or the IRS request comments for the Tennessee Valley Authority.

- Indian Tribal government

- The proposed regulations define Indian tribal government as any Indian or Alaska Native tribe, band, nation, pueblo, village, community, component or component reservation, individually identified in the Federally Recognized Indian Tribe list published by the Department of Interior. Treasury and the IRS are seeking comments regarding whether the proposed definitions encompass the entity structures that Indian tribal governments employ in activities that would give rise to elective payments, including entities with partial Indian tribal governmental ownership.

- Alaska Native Corporation (ANC)

- In instances where a non-ANC member of an ANC-parented group wants to qualify as an applicable entity, the proposed regulations clarify that such members will need to qualify on their own (e.g., as a tax-exempt entity) rather than by the parent’s ANC status. Treasury and the IRS are seeking comments on whether further guidance regarding these relationships is needed.

- Rural Electrical Co-ops

- The proposed regulations provide no further clarification, but Treasury and the IRS requested comments on whether clarification is needed.

The FAQs from the IRS clarify that water districts, public universities and hospitals qualify as applicable entities. Lastly, under the proposed regulations, if a taxpayer is not an applicable entity, the taxpayer can elect to be treated as an applicable entity for credits under §§ 45Q, 45V, and 45X.

Comments on the direct pay and transferability proposed regulations are due August 14, 2023. A hearing for the direct pay proposed regulations is scheduled for August 21, 2023 at 10:00 AM ET; the hearing for the transferability proposed regulations is scheduled for August 23, 2023 at 10:00 AM ET. If you would like further information or to submit comments regarding these proposed regulations, please contact the authors of this article or your Crowell & Moring LLP representative.

Contacts

Insights

Client Alert | 4 min read | 01.07.26

On December 17, 2025, the U.S. Food and Drug Administration (FDA) issued a request for information (RFI) on a proposal designed to help the FDA engage more directly with innovative, venture-backed companies focused on biotechnology, medical devices, AI, and regulatory technology.[i]The RFI includes 19 questions, with responses due by 2:00 p.m. ET on January 18, 2026.

Client Alert | 3 min read | 01.07.26

CMMC for AI? Defense Policy Law Imposes AI Security Framework and Requirements on Contractors

Client Alert | 3 min read | 01.07.26

New Year, Same CIPA Uncertainty – When Will the Appellate Courts Enter the Chat?

Client Alert | 11 min read | 01.07.26