Expanded Paid Sick Leave Requirements to Take Effect in California

Client Alert | 14 min read | 12.05.23

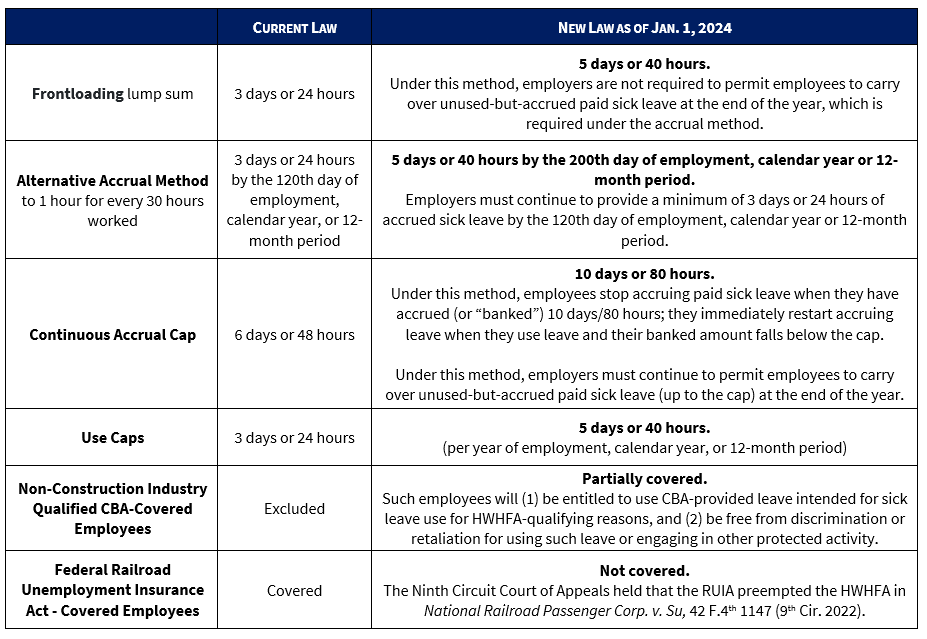

Effective January 1, 2024, California employees will be entitled to accrue and use more paid sick leave per year. On October 4, 2023, California Governor Gavin Newsom signed SB 616 into law, which amends the Healthy Workplaces, Healthy Families Act of 2014 (“HWHFA”) and significantly expands paid sick leave requirements for employers in California. Further, non-construction industry employees covered by a collective bargaining agreement (“CBA”), previously excluded from coverage, will now be entitled to certain benefits and protections under the HWHFA. The amendment also preempts local ordinances that are contrary to the HWHFA with respect to certain issues, for example, rate and timing of pay, and advance leave and notice.

Key Amendments

Partial Preemption of Local Ordinances:

Currently, there are eight local ordinances in California covering paid sick leave (specifically, Berkeley, Emeryville, Los Angeles, Oakland, San Diego, San Francisco, Santa Monica, and West Hollywood). The amendment will preempt “any local ordinance to the contrary” on the following topics:

- Payout & Reinstatement: Employers are not required to pay out accrued-but-unused paid sick leave when employment ends. Employers must, however, reinstate such accrued-but-unused leave for employees rehired within one year of the date of separation unless they paid out such leave at separation.

- Advance Leave: At the employer’s discretion and with proper documentation, employers can advance leave to employees before they accrue it.

- Written Notice: Employers must include on either an itemized paystub, or in a separate writing on payday, the amount of paid sick leave available (or PTO if provided in lieu of sick leave). If an employer provides unlimited paid sick leave or PTO, then itemized statement or written notice must state “unlimited.”

- Rate of Pay: Employers must use the following methods to calculate rate of pay for non-exempt and exempt employees:

- Non-Exempt

- “Paid sick time . . . shall be calculated in the same manner as the regular rate of pay for the workweek in which the employee uses paid sick time, whether or not the employee actually works overtime in that workweek.”

- “Paid sick time . . . shall be calculated by dividing the employee’s total wages, not including overtime premium pay, by the employee’s total hours worked in the full pay periods of the prior 90 days of employment.”

- Exempt

- “Paid sick time . . . shall be calculated in the same manner as the employer calculates wages for other forms of paid leave time.”

- Non-Exempt

- Advance Employee Notice: “If the need for paid sick leave is foreseeable, the employee shall provide reasonable advance notification. If the need for paid sick leave is unforeseeable, the employee shall provide notice of the need for the leave as soon as practicable.”

- Timing of Pay: “An employer shall provide payment for sick leave taken by an employee no later than the payday for the next regular payroll period after the sick leave was taken.”

Employer Next Steps

In advance of the January 1, 2024 effective date, employers should endeavor to:

- Review and, if necessary, revise their current paid sick leave or paid time off policies and handbooks to comply with the amendment’s requirements, particularly as to non-construction industry CBA employees and local ordinances, with appropriate notice to employees;

- Monitor the Department of Industrial Relations website for an updated required workplace poster and guidance; and

- Train managers and HR on the new requirements.

Contacts

Insights

Client Alert | 2 min read | 04.21.25

Agencies to Curtail Unique, Customized Acquisitions in Favor of Commercial Products and Services

On April 16, 2025, the White House issued an Executive Order (“EO”), “Ensuring Commercial, Cost-Effective Solutions in Federal Contracts,” requiring agencies to meet their needs with commercially available products and services to the maximum extent practicable. The EO reiterates and builds upon the requirements set forth in the Federal Acquisition Streamlining Act of 1994 (“FASA”), which similarly encourages the use of commercial acquisition procedures. Specifically, the EO institutes a required review procedure for certain open acquisition actions and establishes an oversight procedure to be implemented for all acquisitions hereafter.

Client Alert | 4 min read | 04.21.25

ClassPass’ Petition for Rehearing Will Tell the Future of Sign-In Wrap Agreements on the Internet

Client Alert | 5 min read | 04.21.25

DOJ Secures First Criminal Wage-Fixing Conviction in Home Health Care Staffing Case

Client Alert | 6 min read | 04.18.25