EU Launches Online Dispute Resolution (ODR) Portal for Consumers

Client Alert | 26 min read | 04.04.16

On February 15, 2016, the European Commission made its new Online Dispute Resolution (ODR) portal available to EU consumers and traders. The ODR portal enables consumers in the EU to resolve complaints against EU traders for goods or services purchased online. In some Member States (currently, Belgium, Germany, Luxembourg, and Poland), traders may also be able to file complaints against consumers. The portal is not available to consumers or traders outside of the EU, and it cannot be used for offline sales or for business-to-business disputes.

[Screenshot from the portal]

Why ODR?

The goal of the ODR is to promote consumer confidence and facilitate Europe’s digital single market. The EU authorized its creation in its Consumer Online Dispute Resolution Regulation (Reg. (EU) No. 524/2013), which built upon the Alternate Dispute Resolution (ADR) Directive (Dir. 2013/11/EU), as a means of providing a quicker, more affordable way for consumers to address disputes with merchants. The ODR provides a streamlined alternative complaint resolution process for consumers who may have previously been intimidated or dissuaded from pursuing claims through litigation, but it does not displace litigation.

How It Works

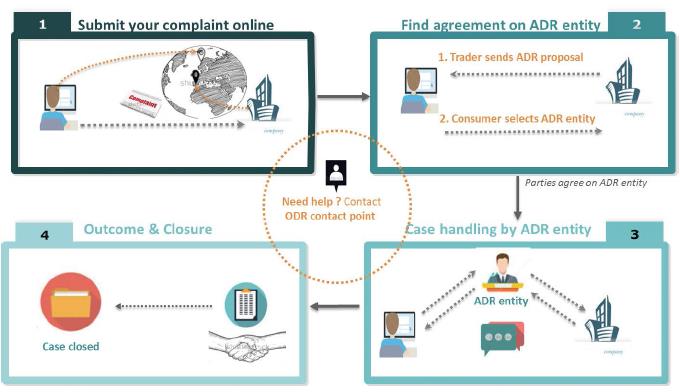

To initiate the complaint resolution process, a consumer provides information by filling in a form on the ODR portal. Data submitted in connection with ODR is protected, consistent with the ODR Regulation’s privacy provisions. The consumer complaint is then sent to the trader, and the parties work to select an ADR entity from those registered in the appropriate Member State. The ODR platform cannot be used if the parties do not agree on an ADR entity. The selected ADR entity then receives the complaint information electronically and handles the case entirely online, conferring with the parties as needed.

[Screenshot from the portal]

The portal is free of charge, multilingual (available in each of the EU’s 23 languages, with automatic translation to facilitate communication between parties, even from different Member States), designed to be easy for consumers to use, and does not required a minimum value of goods for participation. Online traders must provide a link to the ODR portal and their contact email addresses on their websites. There are also strict time limits for ODR: the entire process must be completed within 120 days.

Potential Effects of the Portal

The ODR portal, along with other EU laws like the Consumer Rights Directive (Dir. 2011/83/EU), are intended to increase consumer confidence in online commerce. But will these measures actually achieve the EU’s goals? Whether these measures will achieve the goal of increased online business will turn on consumer use of the ODR portal and trust in online transactions. Online shoppers who feel empowered to pursue complaints and correct problems that they may have previously viewed as unsolvable may shop more online, which could grow e-sales as consumer confidence increases. The ODR only applies to European online transactions, however, and it remains to be seen whether benefits from the ODR portal will impact online sales outside of the EU.

The ODR platform is a uniquely European innovation, calibrated to deal with issues encountered in the EU market. But does that mean that consumers in other markets are less protected? Not necessarily. There are other forces at play in other markets that may afford a similar level of protection to consumers who shop online. In the U.S., for instance, the availability of class action lawsuits, an active plaintiffs’ bar, and the possibility of significant damage amounts all act as a check on unfair business practices. In addition, most other countries do not face the language and other cross-border trading impediments that the EU addresses with the ODR portal. The ODR Portal is one of many approaches to addressing the lack of consumer confidence in online commerce, a common global issue.

Other Articles in This Month's Edition:

- Knocking Out Class Actions After Campbell-Ewald: Can Defendants Still Control Their Destiny?

- Crumb Rubber in the Crosshairs: Focus on Artificial Turf Increases

- Health Canada Announces First Penalty Under CCPSA

- Court Denies Michaels’ Motion to Dismiss CPSC Penalty Enforcement Action and Finds that Failure to Report is a Continuing Violation

- European Commission Launches Review of EU Consumer Legislation

- Advertisers in the Ring – A Roundup of Recent Competitor Advertising Challenges: Enough Tailored Support for Direct Comparisons and Health Benefits?

Contacts

Insights

Client Alert | 10 min read | 12.24.25

Since the signing of Executive Order 14187 (“Protecting Children from Chemical & Surgical Mutilation”) in late January 2025, the Trump Administration has made its skeptical stance on gender-affirming care—especially regarding services provided to minors—clear.

Client Alert | 3 min read | 12.24.25

Keeping it Real: FTC Targets Fake Reviews in First Consumer Review Rule

Client Alert | 5 min read | 12.23.25

An ITAR-ly Critical Reminder of Cybersecurity Requirements: DOJ Settles with Swiss Automation, Inc.

Client Alert | 2 min read | 12.23.25

Record-Setting False Claims Act Settlement Highlights DOJ Commitment to Customs Enforcement