FTC Announces New HSR and Section 8 Thresholds

Client Alert | 13 min read | 01.24.23

The Federal Trade Commission announced yesterday the most significant changes to the jurisdictional thresholds and filing fees applicable to the Hart-Scott-Rodino Antitrust Improvements Act of 1976 (the HSR Act) in several decades.

The HSR Act requires that certain large transactions be notified to the Department of Justice and the Federal Trade Commission prior to their consummation. This year, the minimum "size-of-transaction" threshold for reporting mergers and acquisitions will increase substantially from $101 million to $111.4 million. The "size-of-person" threshold will also increase.

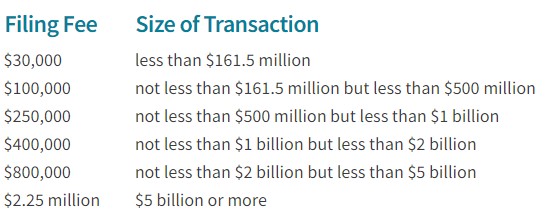

Notifications made under the HSR Act also require the payment of a filing fee, which has historically increased annually based on changes to the U.S. consumer price index. Pursuant to the recently-enacted Fee Modernization Act, the FTC has adopted a new structure—increasing the number of tiers from three to six—and including significant changes to the filing fees themselves. The new structure marginally reduces the filing fees required for smaller transactions, but dramatically increases those required for the largest deals. For example, in 2022, the largest filing fee of $280,000 was required for transactions valued at approximately $1 billion or more. This year, the largest filing fee will be $2.25 million, applicable to transactions valued at $5 billion or more. More detail is included in the chart below.

This new fee structure is expected to significantly increase the total sum of filing fees—with the Congressional Budget Office estimating the changes will generate an additional $1.4 billion in payments from 2023 through 2027—and which will significantly increase the funding and resources available to the FTC and DOJ to enforce the antitrust laws. Under the new structure, HSR filing fees will be increased annually by an amount equal to the percentage increase in the Consumer Price Index, if any, as determined by the Department of Labor.

The revised thresholds were published in the Federal Register on January 26, 2023, and become effective thirty days after publication on the next business day, February 27, 2023.

The Commission also issued revised thresholds relating to the prohibition of certain interlocking directorates under Section 8 of the Clayton Act.

Click here to read a full copy of the Commission's announcement, including a complete listing of the revised thresholds. Click here for a copy of the FTC's announcement and information regarding the Clayton Act, Section 8 thresholds.

Insights

Client Alert | 3 min read | 04.25.24

JUST RELEASED: EPA’s Bold New Strategic Civil-Criminal Enforcement Collaboration Policy

The Environmental Protection Agency’s (EPA’s) Office of Enforcement and Compliance Assurance (OECA) just issued its new Strategic Civil-Criminal Enforcement Policy, setting the stage for the new manner in which the agency manages its pollution investigations. David M. Uhlmann, the head of OECA, signed the Policy memorandum on April 17, 2024, in order to ensure that EPA’s civil and criminal enforcement offices collaborate efficiently and consistently in cases across the nation. The Policy states, “EPA must exercise enforcement discretion reasonably when deciding whether a particular matter warrants criminal, civil, or administrative enforcement. Criminal enforcement should be reserved for the most egregious violations.” Uhlmann repeated this statement during a luncheon on April 23, 2024, while also emphasizing the new level of energy this collaborative effort has brought to the enforcement programs.

Client Alert | 6 min read | 04.25.24

Client Alert | 3 min read | 04.24.24

Client Alert | 2 min read | 04.24.24

FTC Continues Focus on Tracking Technologies and Personal Health Data